Bagged snacks in Convenience is worth £1.6m and is growing at 2%***

85% purchasing snacks at least once a week – 1 in 4 more than once**

Bagged Snacks are in 1 in 5 Convenience baskets*

3 simple selling principles

Right Insights

Understand your shopper and bagged snacks trends. Keep your range relevant to shopper needs.

Right Range

Follow the principles of 25 to thrive and drive growth - 3 principles to follow that will grow your sales.

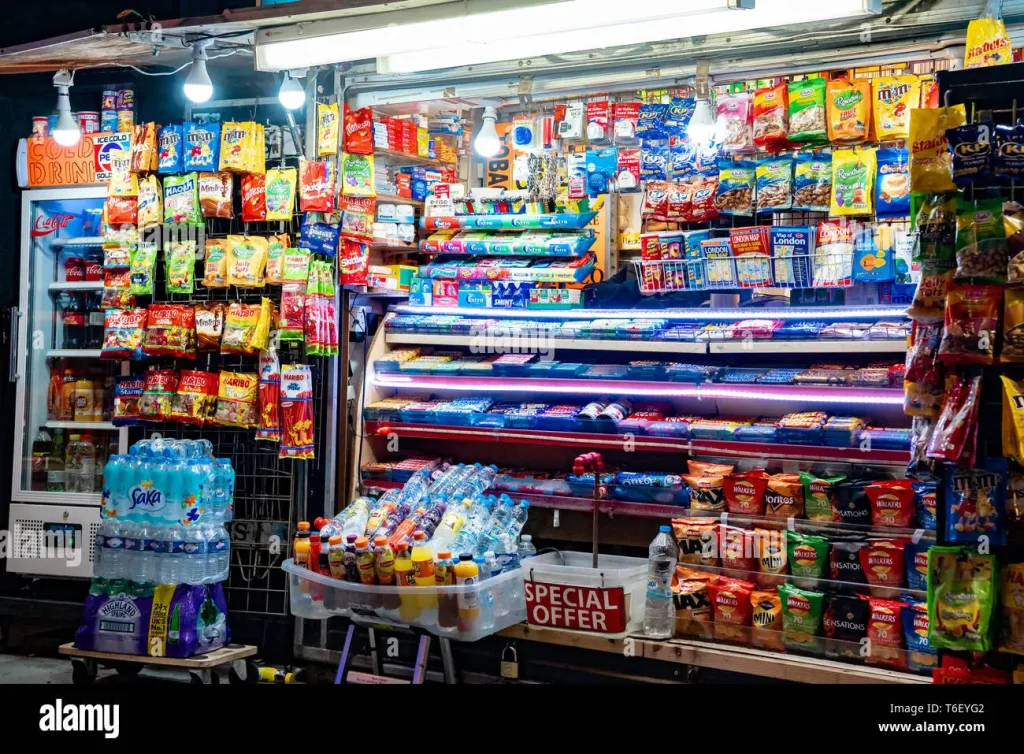

Right Visibility

Excite and engage at the fixture. Use the whole store to drive impulse purchases.

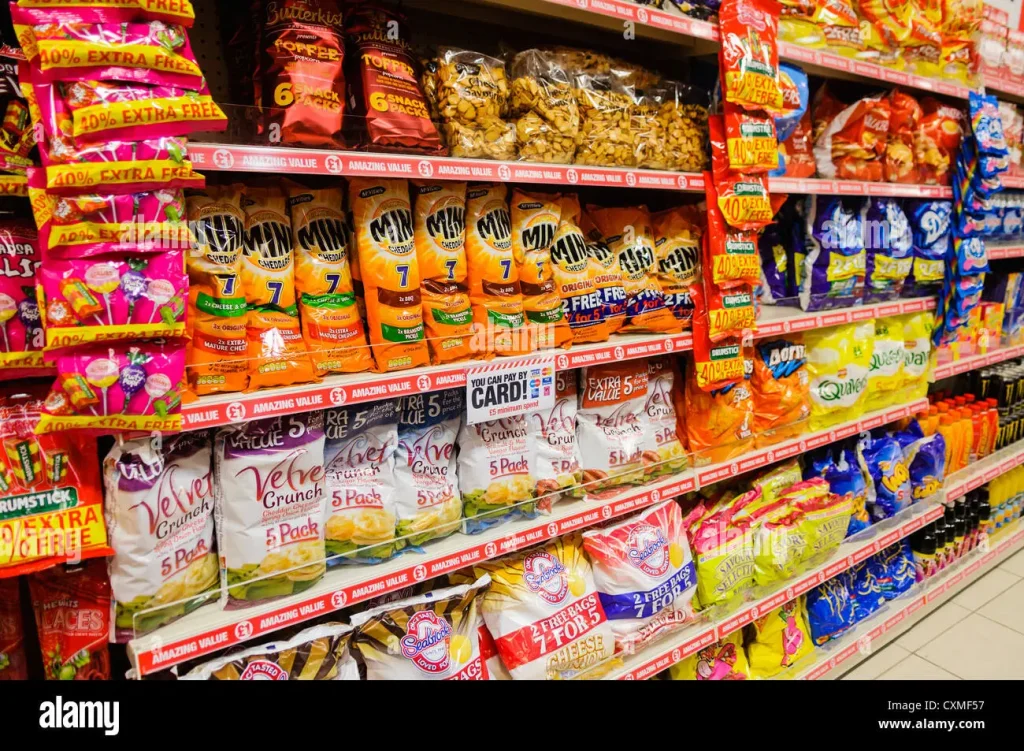

Stock the perfect ranges

25 to thrive is our perfect range guide for symbols and independents

Don't just take

our word

for it

KP Snacks have been there to offer support and guidance, and I have found following their category advice simple and easy to implement. Most importantly it has helped me to keep growing my sales in this important category in particular with the PMP range offering breadth of choice and value for shoppers instore.

Atul Sodha

Convenience Store Owner

Londis - Harefield